In the world of international money transfers, one of the most crucial factors to consider is the fee structure and exchange rates. A transparent and cost-effective system is essential for users, whether they are transferring money for personal or business purposes. As an online money transfer platform, Fastpay247 has become a popular choice for users who want to send money abroad quickly and securely. However, just like any other service, Fastpay247 has its own set of fees and exchange rates that users must understand.

This article aims to provide a detailed explanation of the various fees and exchange rates involved in using Fastpay247. We will break down the costs associated with different services, explain how the exchange rates are calculated, and provide tips on how users can save money while using this platform. Whether you are a first-time user or a regular customer, this guide will help you navigate Fastpay247’s pricing structure and make informed decisions when transferring money internationally.

Section 1: What is Fastpay247?

Before diving into the details of fees and exchange rates, it’s important to first understand what Fastpay247 is and what it offers.

What is Fastpay247?

Fastpay247 is an online money transfer service that allows individuals and businesses to send money across borders quickly and securely. With a focus on affordability and ease of use, Fastpay247 is designed to provide a reliable and efficient way to transfer money to different countries. The platform supports multiple payment methods and currencies, offering users a range of options to suit their specific needs.

Whether you are sending money to family members, paying for goods or services, or conducting international business transactions, Fastpay247 offers a straightforward solution with competitive pricing.

How Does Fastpay247 Work?

Using Fastpay247 is simple and convenient. Users need to create an account on the platform, choose the amount they wish to send, select the recipient’s location and payment method, and review the applicable fees and exchange rates. Once the transaction is confirmed, Fastpay247 processes the transfer and ensures the recipient receives the money through their chosen method, whether via a bank deposit, cash pickup, or mobile wallet.

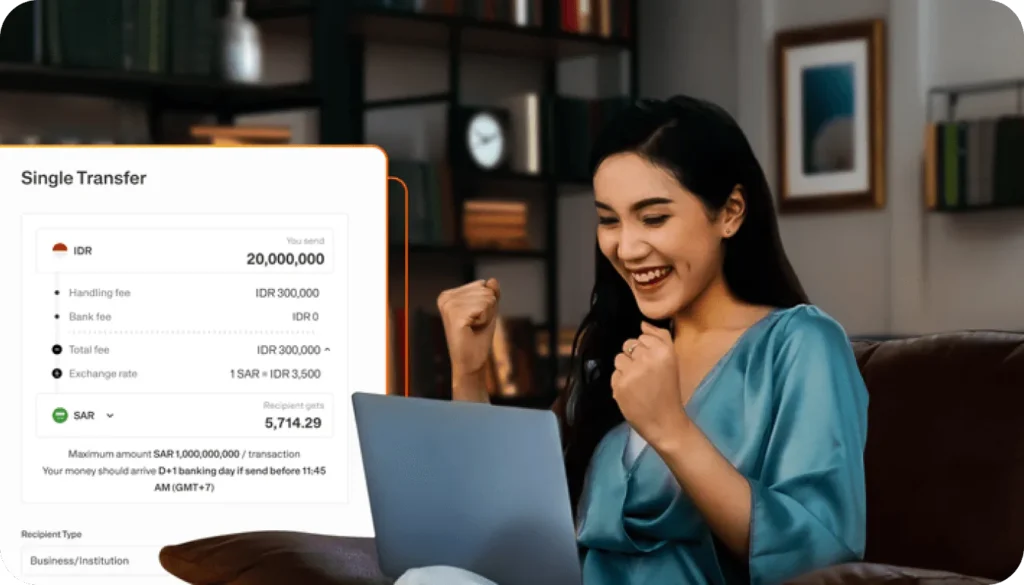

Section 2: Breaking Down the Fees on Fastpay247

One of the key factors that users need to understand before using Fastpay247 is the fee structure. Like many other money transfer platforms, Fastpay247 charges fees for its services. These fees can vary depending on several factors, including the amount of money being sent, the payment method chosen, and the destination country. Let’s take a closer look at the different types of fees that users may encounter.

1. Transfer Fees

Transfer fees are the most common charges associated with sending money through Fastpay247. These fees can either be a flat rate or a percentage of the total transfer amount, depending on various factors.

Flat Rate Fees

For smaller transactions, Fastpay247 may charge a flat fee, which is the same regardless of the transfer amount. For example, if you are sending $100, the fee might be a fixed $5. Flat rate fees are typically easier to understand and predictable, which is helpful for users who need to send small amounts of money.

Percentage-Based Fees

For larger transfers, Fastpay247 may apply a percentage-based fee, which is calculated based on the total amount being sent. For example, if the fee is 2% and you are transferring $1,000, the fee would be $20. This fee structure is often used for higher-value transactions and ensures that the platform earns a fair amount for processing larger sums of money.

2. Payment Method Fees

The method used to fund the transaction can significantly impact the fees you pay. Different payment methods come with different costs, so it’s important to choose the one that best suits your needs. Common payment methods include:

- Bank Transfers: Typically, the cheapest method for sending money via Fastpay247. However, the sender’s bank may charge additional fees for international transfers, which could be passed on to you.

- Credit or Debit Cards: Using a credit or debit card can be more expensive than a bank transfer. While it’s faster and more convenient, card payments often incur higher processing fees, which are usually passed along to the user.

- Mobile Wallets: If you are using a mobile wallet, the fees may vary depending on the specific provider and the country you are sending money to. Some mobile wallets offer low-cost transfers, while others may charge higher fees for certain types of transactions.

3. Receiving Fees

In addition to transfer fees, Fastpay247 may also charge receiving fees, depending on how the recipient collects the funds. These fees are typically separate from the sender’s fees and can be applied by the receiving bank or agent.

Bank Account Deposits

If the recipient is receiving money via a bank deposit, the recipient’s bank may charge a processing fee. This is particularly true for international transfers, where additional fees may be applied to cover the cost of processing foreign currency.

Cash Pickup

For recipients who choose to pick up cash from an agent or partner location, a fee may be charged for the service. Cash pickup fees can vary based on the country and the agent location, and the amount of money being received.

4. Expedited Service Fees

Sometimes, users may need their money to arrive faster than usual. Fastpay247 offers expedited services, such as same-day or next-day transfers, for an additional fee. While these services can be invaluable in urgent situations, they come at a premium.

If you are not in a rush, you can save money by choosing standard transfer options, which typically have lower fees.

Section 3: How Exchange Rates Impact the Cost of Transfers

When sending money internationally, the exchange rate plays a crucial role in determining the overall cost of the transfer. Fastpay247 offers competitive exchange rates, but there may be a slight markup on the market rate, which can result in a higher cost for the user. Understanding how exchange rates work can help you minimize costs when using Fastpay247.

1. Market Exchange Rates vs. Fastpay247 Rates

The market exchange rate is the rate at which one currency can be exchanged for another on the global market. However, Fastpay247 may apply a markup to the market rate when converting currencies. This markup is typically a small percentage added to the exchange rate, which can increase the cost of the transfer.

For example, if the market exchange rate for USD to EUR is 1 USD = 0.85 EUR, Fastpay247 may offer an exchange rate of 1 USD = 0.83 EUR. The difference of 0.02 EUR per dollar is the markup, and it represents an additional cost for the user.

2. How the Exchange Rate Affects Your Transfer

The exchange rate directly impacts how much the recipient will receive. If the exchange rate is lower than the market rate, the recipient will get fewer funds in their local currency. Conversely, if the exchange rate is higher, the recipient will receive more money.

To ensure you are getting the best deal, it’s important to compare the exchange rates offered by Fastpay247 with other money transfer services. If Fastpay247 offers a competitive exchange rate, you’ll save money on the transfer.

3. Currency Conversion Fees

In addition to the exchange rate markup, some platforms may charge a currency conversion fee. This fee is typically a percentage of the total amount being converted and is added to the transfer cost. While Fastpay247 generally aims to keep its fees low, it’s still important to check if any additional currency conversion fees apply to your transfer.

Section 4: Tips for Minimizing Fees and Maximizing Savings on Fastpay247

While Fastpay247 offers a competitive pricing structure, users can still take steps to minimize the fees and maximize their savings. Here are some tips to help you reduce costs when using Fastpay247:

1. Choose the Right Payment Method

As mentioned earlier, different payment methods come with different fees. Bank transfers are usually the most affordable option, so choose this method if you don’t need the money to arrive immediately. Credit or debit card payments may be more convenient but come with higher fees.

2. Plan Your Transfers in Advance

If you can plan your transfers in advance, you may be able to avoid expedited transfer fees. By choosing the standard transfer option, you can save money and avoid paying extra for a faster service.

3. Compare Exchange Rates

Before finalizing your transfer, compare the exchange rates offered by Fastpay247 with those of other services. This will ensure you get the best deal and avoid unnecessary costs.

4. Be Aware of Receiving Fees

When sending money, don’t forget to check if the recipient will incur any fees for receiving the funds. Understanding the receiving fees can help you better estimate the total cost of the transfer.

Section 5: Conclusion – Making the Most of Fastpay247’s Fees and Exchange Rates

In conclusion, Fastpay247 provides a transparent and affordable way to send money internationally. While there are fees associated with using the platform, understanding how these fees are calculated and how exchange rates work can help you make more cost-effective decisions. By choosing the right payment method, planning ahead, and being aware of potential receiving fees, you can save money and ensure that your transfer is as affordable as possible.

Fastpay247 offers competitive pricing and a reliable service, making it an excellent choice for individuals and businesses looking to send money across borders. By understanding its fee structure and exchange rate policies, you can make the most of the platform and ensure that your international money transfers are both efficient and affordable.