As we move into 2024, 2024 market predictions are top of mind for investors and analysts alike. Will the market be bullish, signaling growth and prosperity, or will it turn bearish, suggesting a downturn? Understanding these predictions can help investors make strategic decisions in a highly volatile environment. In this article, we’ll look at the top 5 insights from financial analysts about 2024 market predictions, covering key trends, economic factors, and industry insights.

1. 2024 Market Predictions: Will It Be a Bull Market?

A bull market is characterized by rising stock prices, increased investor confidence, and generally optimistic economic indicators. Many experts in 2024 market predictions are cautiously optimistic, pointing to a potential bull market. Here are some key factors:

- Strong Economic Recovery: Economies worldwide are recovering post-pandemic, with GDP growth expected in several major regions. For 2024, economic growth could continue to fuel a bullish outlook.

- Low Unemployment Rates: With employment stability, consumer spending often increases, contributing to higher stock prices and stronger markets.

2. Are We Headed for a Bear Market? Key 2024 Market Predictions for Investors

On the other side of the spectrum, bear market predictions are also prevalent among analysts. Several factors could point to a less optimistic forecast for 2024 market predictions:

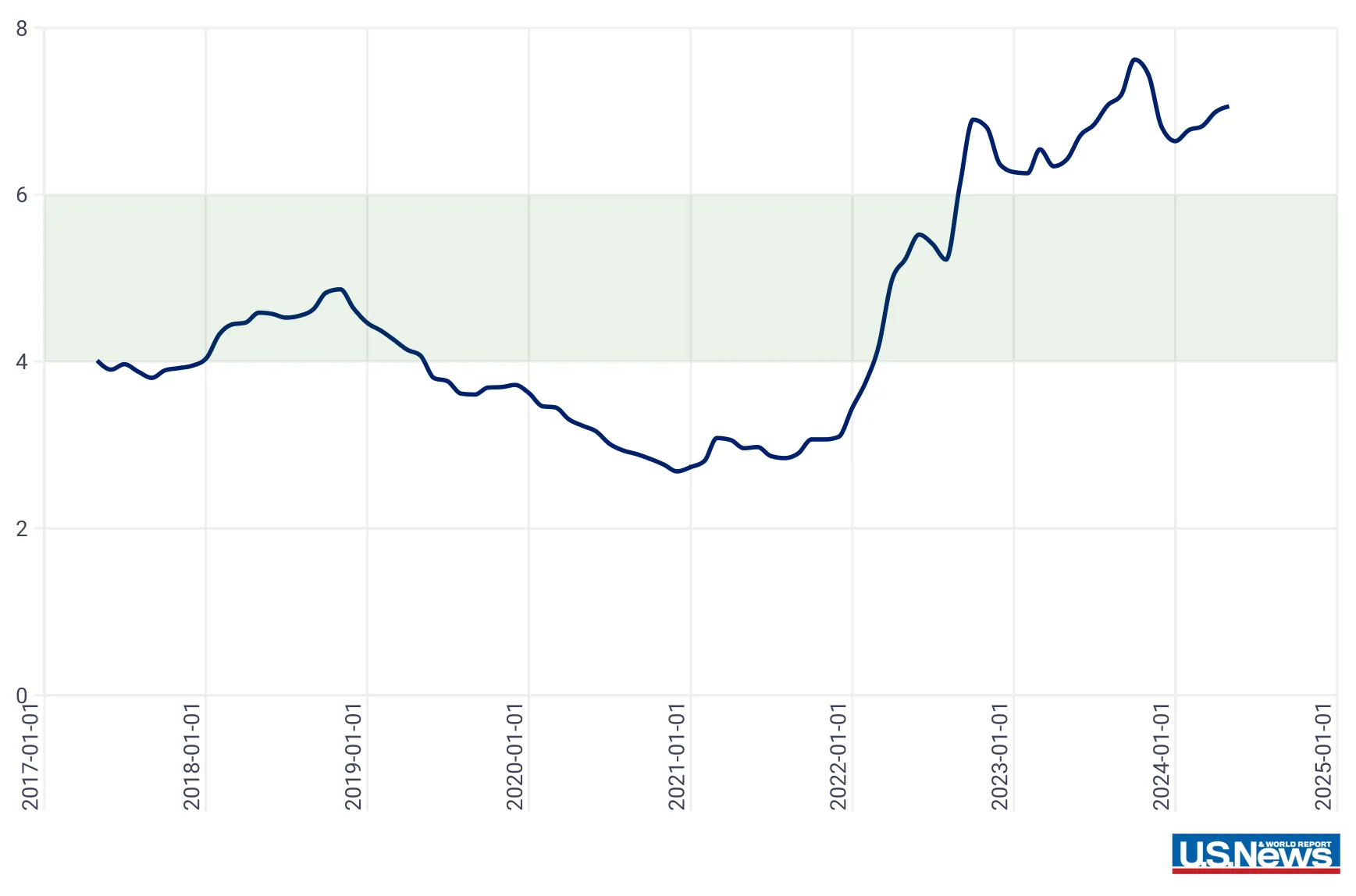

- Rising Interest Rates: To combat inflation, central banks may increase interest rates. Higher interest rates often lead to a slowdown in borrowing and consumer spending, which can depress market performance.

- Global Debt and Inflation: Inflation remains a significant factor in many economies. If inflation persists without control, it could lead to decreased purchasing power, thus pushing the market toward a bearish outlook.

3. Expert Opinions: What Analysts Say About Key Sectors for 2024 Market Predictions

Certain sectors are expected to outperform others, regardless of whether the market is bullish or bearish. Here’s what analysts are predicting about sector trends for 2024 market predictions:

- Technology: With advancements in artificial intelligence and cloud computing, the technology sector remains strong. Many analysts believe technology stocks will see growth, particularly in fields related to AI, green tech, and cybersecurity.

- Healthcare: With an aging population and ongoing health innovation, healthcare remains a strong sector. Biotech and pharmaceutical companies are especially likely to perform well in 2024.

- Energy: With a global push towards renewable energy, energy companies focusing on sustainable solutions are predicted to see positive growth. This trend is highlighted in many 2024 market predictions as a significant area for investment.

4. Global Events and 2024 Market Predictions: What to Watch

Global events can play a critical role in market performance. Here are some global influences expected to shape 2024 market predictions:

- Geopolitical Tensions: Ongoing geopolitical issues, such as trade relations between the U.S. and China, can impact global markets. Tariffs, sanctions, and regulatory shifts could affect specific industries and alter market predictions.

- Environmental Policies: Climate policies are increasingly influential. Governments worldwide are implementing stricter regulations on emissions, which could benefit sectors like green technology and sustainable energy.

5. Investment Strategies for 2024 Market Predictions

Understanding 2024 market predictions is essential for creating a solid investment strategy. Here are some strategies based on predictions for both bull and bear market scenarios:

- Diversification: Diversify your portfolio to reduce risk. A mix of stocks, bonds, and other assets can provide a cushion against market volatility.

- Consider Safe-Haven Assets: In uncertain times, investors often turn to safe-haven assets like gold or treasury bonds. These assets typically retain value even when markets are unstable, making them valuable in a bearish environment.

- Focus on Growth Stocks in Bullish Sectors: If a bull market is anticipated, consider growth stocks in sectors with strong upside potential, such as technology, healthcare, and energy.

Conclusion

Whether 2024 brings a bear or bull market remains uncertain, but 2024 market predictions from analysts provide valuable insights. By staying informed about potential economic indicators, sector performance, and global events, investors can make strategic choices to protect and grow their investments. Stay tuned for more updates as new predictions for 2024 emerge, and remember to keep your investment strategy aligned with the evolving market landscape.