Ethereum 2.0 Price Impact has become a hot topic among investors and crypto enthusiasts, raising questions about the upgrade’s influence on ETH price predictions. As Ethereum undergoes a significant transformation, understanding the effects of Ethereum 2.0 on ETH’s value is essential for anyone in the crypto market. In this article, we will explore how Ethereum 2.0 price impact may shape future price predictions, and what investors can expect in the coming months.

What is Ethereum 2.0?

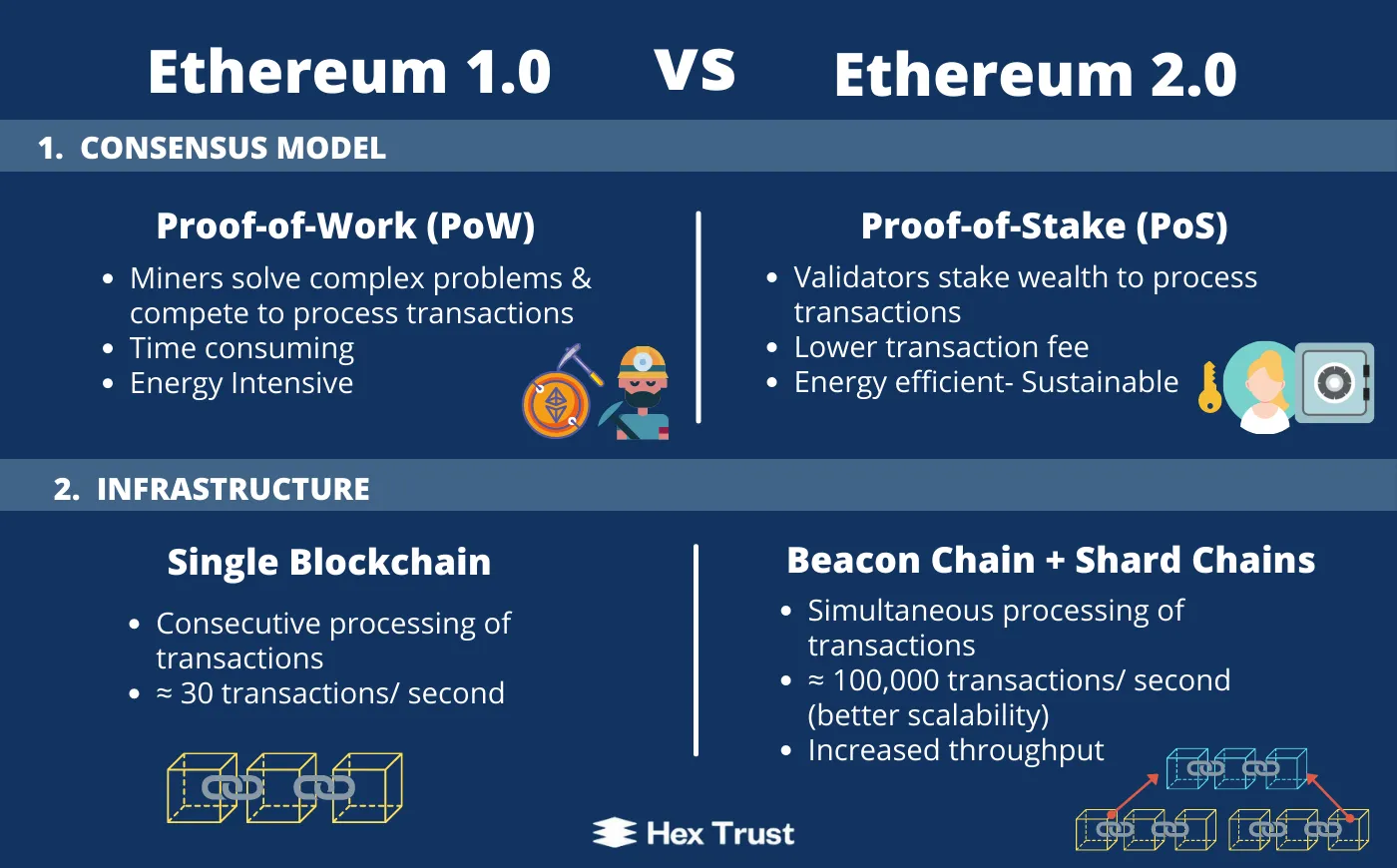

Ethereum 2.0, or ETH 2.0, represents a major upgrade to the Ethereum blockchain, shifting from Proof of Work (PoW) to Proof of Stake (PoS). This transformation aims to increase scalability, improve security, and reduce energy consumption, making Ethereum more sustainable. By examining Ethereum 2.0 price impact, we can better understand the potential value shifts in ETH as it enters a new era of blockchain technology.

Why Ethereum 2.0 Matters for Price Predictions

The Ethereum 2.0 price impact could have major consequences on ETH’s market value. With its advancements in scalability, reduced environmental impact, and enhanced security, Ethereum 2.0 has the potential to draw in more investors, push transaction volumes higher, and ultimately influence price predictions. Let’s dive into the core factors behind Ethereum 2.0 price impact.

1. Transition to Proof of Stake and Its Impact on Supply and Demand

The transition from PoW to PoS could significantly impact ETH’s price. By shifting to Proof of Stake, Ethereum 2.0 limits the need for energy-intensive mining and enables ETH holders to validate transactions by staking their coins.

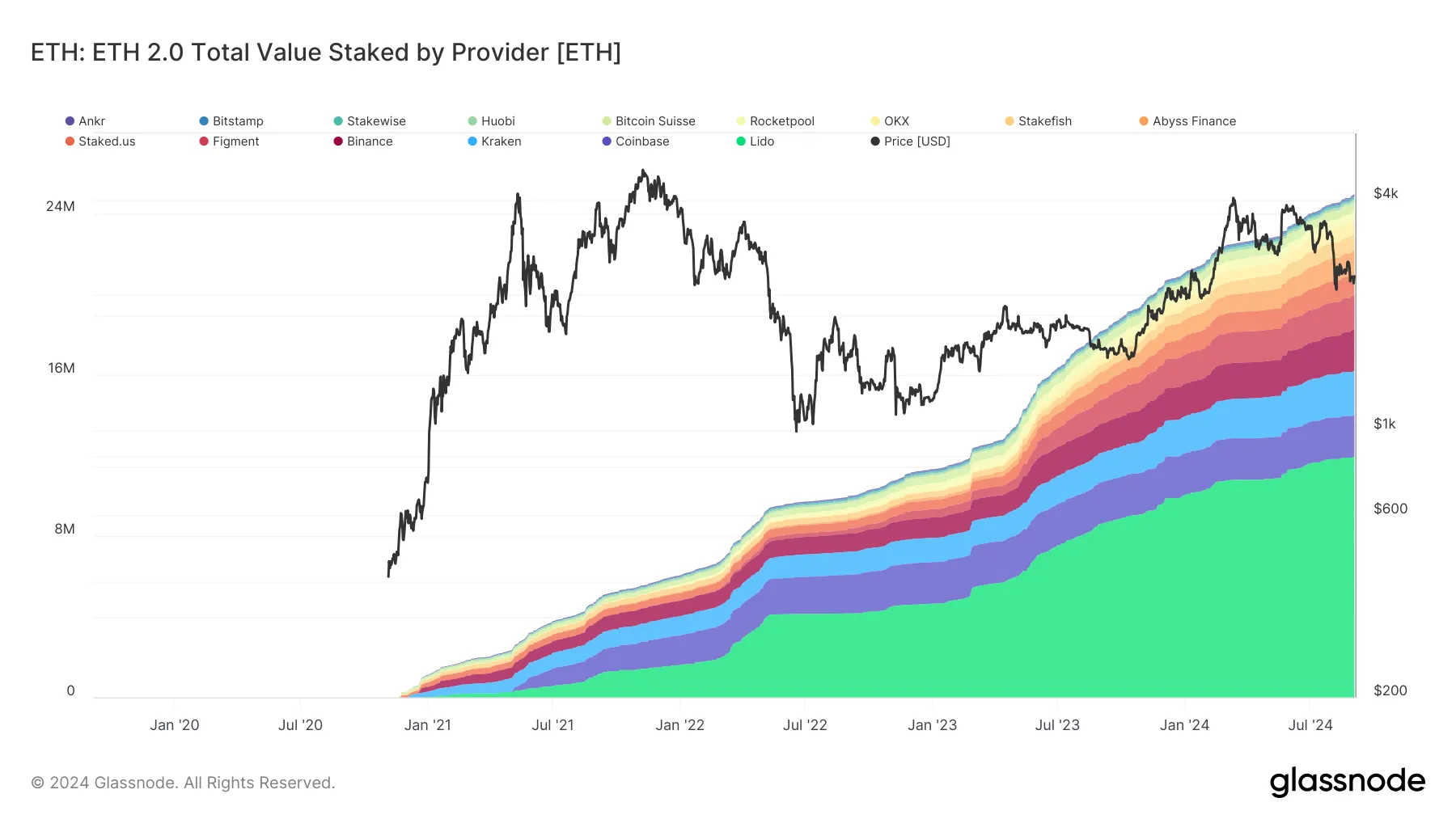

- Increased Demand through Staking: The staking mechanism locks up a substantial amount of ETH, decreasing its circulation. This scarcity effect could have a positive Ethereum 2.0 price impact by creating a supply-demand imbalance.

- Reduced Selling Pressure: PoS reduces the need for miners who often sell ETH to cover operational costs, which can lead to lower selling pressure and stabilize prices.

These changes suggest that Ethereum 2.0 price impact will be influenced by the dynamics of supply and demand, which could support a bullish ETH price prediction.

2. Ethereum 2.0’s Scalability Improvements and Market Value

Ethereum has long struggled with scalability, limiting its transaction processing speed. With Ethereum 2.0, the introduction of shard chains could improve scalability by dividing the network into smaller parts, allowing more transactions to be processed simultaneously.

- Improved User Experience: With higher throughput, users can expect lower transaction fees and faster transaction times, which could attract more users and developers to the platform.

- Potential Price Growth: As scalability issues decrease, the Ethereum 2.0 price impact could be reflected in higher user adoption, resulting in increased demand for ETH and a potential price appreciation.

These scalability improvements highlight the positive Ethereum 2.0 price impact that investors are eager to see, making Ethereum more competitive in the DeFi and NFT markets.

3. Environmental Benefits and Market Perception

Ethereum’s shift to PoS has the added advantage of lowering its environmental impact, addressing concerns over energy consumption associated with crypto mining. As sustainability becomes increasingly important, Ethereum 2.0’s eco-friendly design could enhance ETH’s appeal to investors.

- Attracting Environmentally Conscious Investors: With the greener model of Ethereum 2.0, institutional investors may view ETH as a more sustainable asset, potentially driving up demand.

- Boosting Market Sentiment: The Ethereum 2.0 price impact also extends to market sentiment. A positive perception of Ethereum’s eco-friendliness could attract more mainstream media coverage and public interest, supporting price growth.

4. Security Upgrades and Their Effect on ETH Price

Security has always been paramount in blockchain. Ethereum 2.0 introduces enhanced security measures that help protect the network from attacks, making it safer for users.

- Higher Investor Confidence: By improving security, Ethereum 2.0 can boost investor confidence, increasing the likelihood of price stability and growth.

- Attracting Institutional Investments: Stronger security could also attract more institutional investors, positively influencing the Ethereum 2.0 price impact as institutional funds flow into the ecosystem.

Enhanced security in Ethereum 2.0 could result in a more stable and robust network, fostering a positive Ethereum 2.0 price impact.

5. Market Trends and Speculative Impacts

As Ethereum 2.0 unfolds, speculative buying may drive up ETH’s price. Investor excitement over potential long-term benefits of the upgrade can lead to higher buying activity in the short term.

- Short-Term Price Surges: Speculative buying surrounding Ethereum 2.0 price impact can cause temporary price spikes, particularly around the phases of the upgrade.

- Long-Term Price Stability: While speculative movements may initially inflate ETH’s price, the fundamental improvements in Ethereum 2.0 provide a foundation for sustained growth, potentially stabilizing the price long-term.

Challenges and Potential Risks with Ethereum 2.0 Price Impact

Despite the optimistic Ethereum 2.0 price impact, there are potential risks investors should be aware of:

- Technical Risks: The upgrade involves complex technology, and unforeseen issues may arise, causing temporary price drops.

- Market Competition: Competing platforms like Solana and Polkadot may still challenge Ethereum, which could affect ETH’s market share and pricing.

- Economic Conditions: The broader economic environment may impact ETH price predictions, as recession fears or regulatory changes could sway investor sentiment.

These challenges do not negate the potential Ethereum 2.0 price impact, but they do provide valuable context for more cautious ETH price predictions.

Ethereum 2.0 Price Predictions: What Analysts Are Saying

With the Ethereum 2.0 price impact expected to be significant, various analysts have shared their insights on future ETH price predictions:

- Short-Term Predictions: Analysts predict a short-term ETH price increase due to market enthusiasm surrounding Ethereum 2.0, with some estimating prices between $2,500 and $3,000 within the first year of the upgrade.

- Long-Term Predictions: For long-term predictions, analysts expect Ethereum 2.0’s scalability, security, and eco-friendly design to push ETH beyond $5,000 in the coming years.

Conclusion: Will Ethereum 2.0 Truly Impact ETH’s Price?

The Ethereum 2.0 price impact appears promising for ETH’s future, with improvements in scalability, security, and sustainability enhancing its appeal. While challenges remain, the upgrade sets a strong foundation for Ethereum to grow and potentially appreciate in value over time.

For investors, the Ethereum 2.0 price impact could mean an opportune time to consider Ethereum as part of a diversified portfolio. As the upgrade continues to roll out, it will be crucial to stay informed on the latest developments and market trends.