In the ever-evolving landscape of investment options, understanding Bitcoin vs. Gold predictions has become crucial for investors seeking to safeguard their wealth. Both Bitcoin and gold have long been viewed as safe havens during times of economic uncertainty. This article will dive deep into the long-term forecasts for Bitcoin and gold, assessing their potential as hedges against inflation, market volatility, and geopolitical risks.

The Importance of Hedging in Investment

Before delving into the Bitcoin vs. Gold predictions, it is essential to understand what hedging means in the context of investment. Hedging is a risk management strategy employed by investors to offset potential losses in one asset by investing in another. Gold has historically been regarded as a hedge against inflation and currency fluctuations, while Bitcoin is often referred to as “digital gold” for its perceived scarcity and decentralized nature.

Understanding Bitcoin and Gold as Investments

Bitcoin: A Digital Asset Revolution

Bitcoin, the first cryptocurrency, was created in 2009 by an anonymous entity known as Satoshi Nakamoto. Its decentralized nature, capped supply of 21 million coins, and growing acceptance as a form of payment contribute to its allure as an investment.

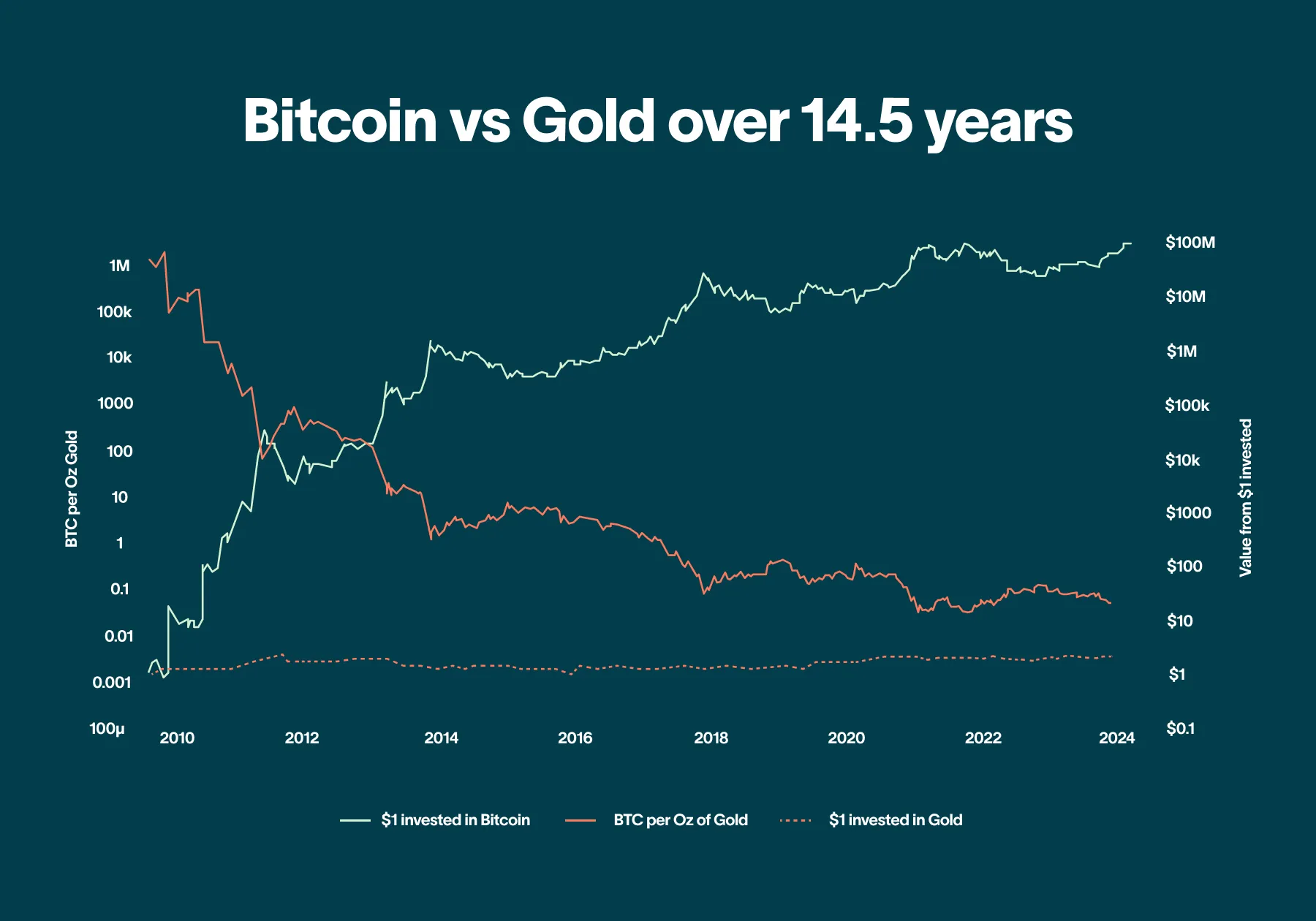

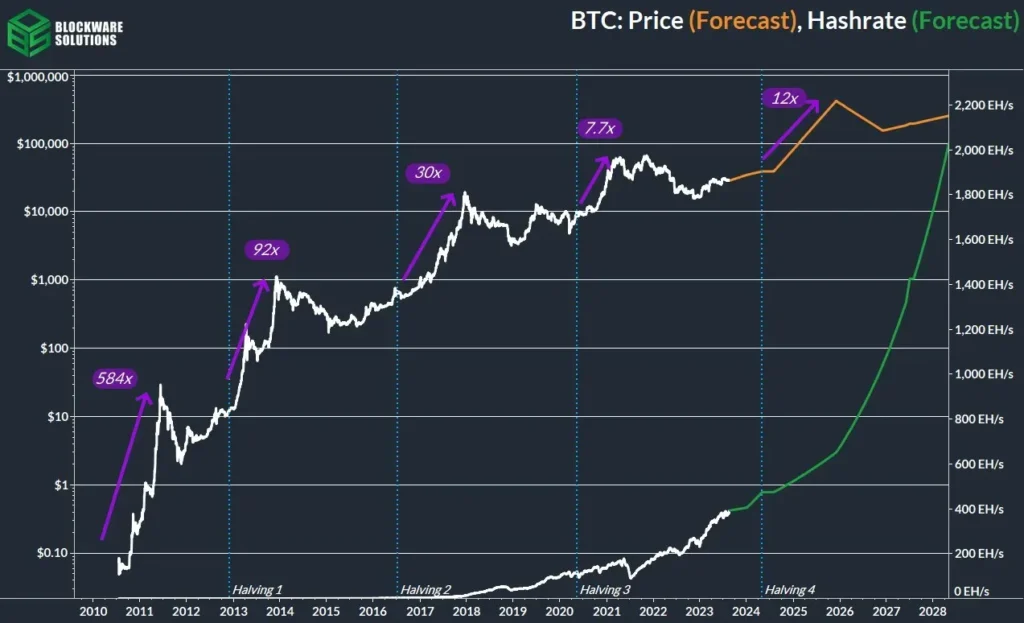

- Volatility and Growth Potential: The price of Bitcoin is known for its volatility, with substantial price swings that can lead to significant profits or losses. Many investors are drawn to this potential for high returns, particularly as more institutional investors enter the market.

- Adoption and Use Cases: The increasing acceptance of Bitcoin for transactions and investments, coupled with the development of financial products like Bitcoin ETFs, suggests a growing mainstream adoption.

Gold: A Traditional Safe Haven

Gold has been a reliable store of value for centuries, serving as a hedge against inflation and economic downturns. Its intrinsic value, limited supply, and historical significance contribute to its stability as an investment.

- Tangible Asset: Unlike Bitcoin, gold is a physical asset that can be held and stored. This tangibility appeals to investors seeking a traditional hedge against market volatility.

- Inflation Hedge: Gold has a long-standing reputation for preserving wealth during inflationary periods, making it a go-to choice for conservative investors.

Analyzing Long-Term Bitcoin vs. Gold Predictions

1. Market Dynamics and Price Predictions

Understanding the market dynamics is essential when analyzing Bitcoin vs. Gold predictions. Various factors influence the price of both assets:

- Supply and Demand: The limited supply of Bitcoin creates scarcity, while gold’s availability is influenced by mining output and geopolitical factors.

- Institutional Adoption: Increasing institutional investment in Bitcoin could drive its price higher. Predictions suggest that Bitcoin could reach new heights as more financial entities recognize its potential.

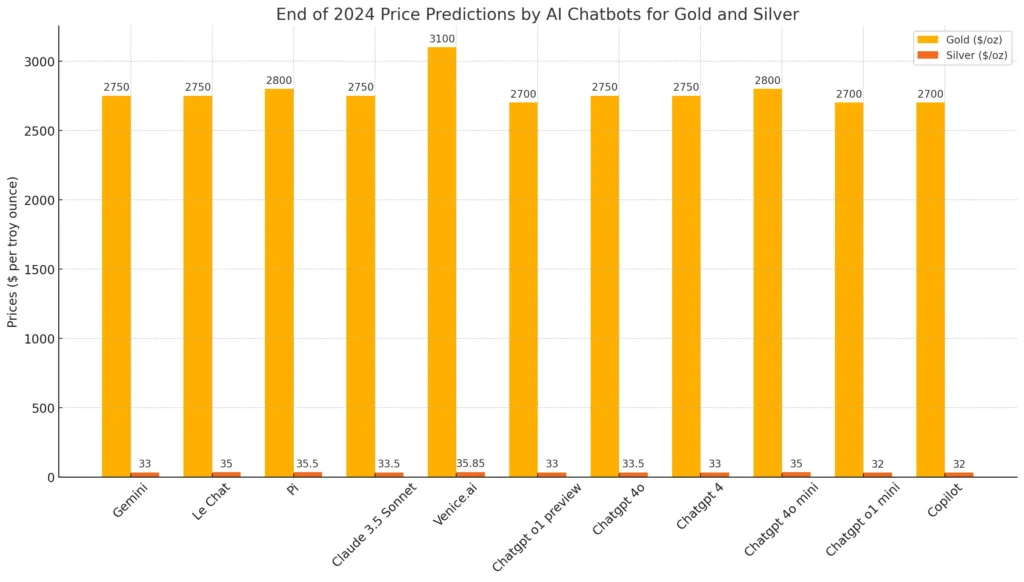

- Gold’s Stability: While gold prices may experience fluctuations, predictions indicate that it will remain relatively stable, especially during economic crises.

2. Inflation and Economic Uncertainty

Inflation is a significant concern for investors, prompting a closer look at how Bitcoin vs. Gold predictions play out in times of rising prices:

- Bitcoin as a Hedge: Some analysts argue that Bitcoin’s fixed supply makes it a superior hedge against inflation compared to gold. As fiat currencies devalue, Bitcoin’s scarcity could drive its price upward.

- Gold’s Historical Role: Gold has historically maintained its value during inflationary periods. Many investors trust gold to provide stability when economic uncertainty prevails.

3. Geopolitical Risks and Financial Crises

Geopolitical tensions and financial crises can significantly impact investment strategies. Here’s how both assets fare in such scenarios:

- Bitcoin’s Decentralization: Bitcoin operates independently of any central authority, making it an attractive option for those looking to escape government control or economic instability. Predictions indicate that Bitcoin could see increased demand during geopolitical unrest.

- Gold’s Safe Haven Appeal: Gold’s status as a safe haven asset remains unchallenged. In times of crisis, investors often flock to gold, driving its prices higher. Predictions suggest that gold will continue to serve as a buffer against geopolitical risks.

4. The Future of Bitcoin vs. Gold Predictions

As we look toward the future, the landscape of Bitcoin vs. Gold predictions is constantly evolving. Here are key considerations for investors:

- Technological Advancements: As Bitcoin technology matures, it may become even more widely accepted as a form of payment and investment. Predictions indicate that advancements in blockchain technology will further legitimize Bitcoin in the eyes of institutional investors.

- Environmental Concerns: Bitcoin mining’s environmental impact has sparked debate. As sustainability becomes a priority, Bitcoin may face challenges in gaining acceptance, whereas gold’s mining practices are also under scrutiny. The implications of these concerns will play a role in future predictions.

- Regulatory Landscape: The regulatory environment surrounding cryptocurrencies is evolving. Future regulations could impact Bitcoin’s growth and adoption. Meanwhile, gold’s established status as a regulated asset provides a level of security for investors.

Conclusion

In the long-standing debate of Bitcoin vs. Gold predictions, both assets have their merits as hedges against economic uncertainty. Bitcoin offers a high-risk, high-reward investment opportunity with significant growth potential, while gold provides stability and security through its historical role as a safe haven.

Ultimately, the decision to invest in Bitcoin or gold depends on individual risk tolerance, investment goals, and market conditions. As the financial landscape continues to evolve, investors should remain informed and flexible in their strategies to effectively navigate the complexities of hedging their wealth.