Bitcoin price trends are essential for investors and traders looking to navigate the volatile cryptocurrency market. As we approach November 2024, understanding the factors that influence Bitcoin’s price will help you make informed decisions. In this article, we will analyze the current market situation, explore historical trends, and provide predictions for Bitcoin’s price in the coming month.

Understanding Bitcoin Price Trends

What Influences Bitcoin Price Trends?

Before diving into the Bitcoin price trends, it’s crucial to understand the factors that influence Bitcoin’s price movements. These factors include:

- Market Demand and Supply: The fundamental law of supply and demand plays a significant role in determining Bitcoin’s price.

- Regulatory Changes: Government regulations can have a profound impact on cryptocurrency prices.

- Technological Developments: Innovations and upgrades in the Bitcoin network can affect investor sentiment.

- Global Economic Factors: Economic conditions, inflation rates, and geopolitical events can influence investor confidence in Bitcoin.

Historical Bitcoin Price Trends

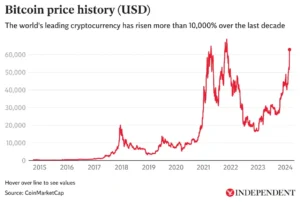

To predict future Bitcoin price trends, we need to analyze historical price movements. Historically, Bitcoin has experienced several cycles of boom and bust, often influenced by the aforementioned factors.

1. Bull Markets and Bear Markets

Bitcoin’s history is marked by notable bull markets, where prices surged significantly, followed by bear markets characterized by steep declines. For example:

- 2017 Bull Run: Bitcoin’s price skyrocketed from around $1,000 to nearly $20,000.

- 2018 Bear Market: Following the 2017 highs, Bitcoin fell to about $3,000 by the end of 2018.

2. Recent Price Movements

As we approach November 2024, Bitcoin has shown some interesting price trends. Here’s a brief overview of recent movements:

- Late 2023: Bitcoin experienced a resurgence, climbing from around $25,000 to $40,000.

- Mid-2024 Correction: The price corrected to approximately $30,000 due to regulatory concerns and profit-taking.

Current Market Analysis for November 2024

Bitcoin Price Trends in Q4 2024

As we enter the last quarter of 2024, analyzing current Bitcoin price trends is crucial for anticipating future movements. The current price, investor sentiment, and macroeconomic factors all contribute to the market landscape.

1. Current Price Levels

As of October 2024, Bitcoin is trading at approximately $35,000. This level is significant as it has served as a support zone in the past.

2. Investor Sentiment

Investor sentiment is crucial in determining short-term price trends. Positive news regarding institutional adoption and technological advancements can lead to increased buying pressure, while negative regulatory news can create panic selling.

Predictions for Bitcoin Price in November 2024

Now that we’ve analyzed the historical context and current market dynamics, let’s explore predictions for Bitcoin price trends in November 2024.

1. Bullish Scenario

In a bullish scenario, several factors could propel Bitcoin’s price higher:

- Increased Institutional Investment: If major financial institutions continue to adopt Bitcoin, it could lead to increased demand and higher prices.

- Technological Advancements: Positive developments in Bitcoin’s scalability and transaction speed could enhance user confidence and drive up prices.

2. Bearish Scenario

Conversely, several factors could lead to a bearish trend:

- Regulatory Crackdowns: Stricter regulations in key markets could result in reduced demand and a falling price.

- Global Economic Uncertainty: Economic downturns and inflation concerns may lead investors to flee risky assets like Bitcoin.

How to Prepare for Bitcoin Price Trends

To navigate the potential price trends in November 2024, here are some strategies for investors:

1. Stay Informed

Keeping up with the latest news and trends in the cryptocurrency space is crucial. Use reputable sources and follow industry experts to stay updated on Bitcoin price trends.

2. Diversify Your Investments

While Bitcoin is a significant player in the cryptocurrency market, diversifying your investment portfolio can help mitigate risks associated with price fluctuations.

3. Set Clear Goals

Establish clear investment goals based on your risk tolerance and time horizon. Whether you aim for short-term gains or long-term holdings, having a plan will help you navigate market volatility.

Conclusion

Bitcoin price trends are influenced by a myriad of factors, from market demand and regulatory developments to global economic conditions. As we approach November 2024, understanding these trends is essential for making informed investment decisions. By analyzing historical data, current market dynamics, and potential future scenarios, you can better navigate the unpredictable landscape of Bitcoin investing. Stay informed, adapt your strategies, and position yourself to capitalize on the opportunities that lie ahead in the cryptocurrency market.