Bitcoin Price Prediction 2025 is a topic of growing interest as investors and crypto enthusiasts wonder, “Will BTC hit $100,000 by 2025?” With Bitcoin’s track record of volatility and impressive growth, many believe that a six-figure price point could be possible within the next few years. In this article, we’ll explore the key factors influencing Bitcoin’s potential value, expert predictions, and the broader implications of a $100,000 Bitcoin.

1. What Drives Bitcoin’s Value?

Understanding Bitcoin price prediction 2025 requires a grasp of the forces shaping Bitcoin’s price. Key drivers include:

- Supply and Demand: Bitcoin’s limited supply of 21 million coins and rising demand create a scarcity effect that supports price growth.

- Halving Events: Bitcoin’s halving events, which occur approximately every four years, reduce mining rewards, often leading to increased prices in the following months.

- Institutional Interest: Increased participation from institutional investors, like banks and funds, has helped legitimize Bitcoin and fuel significant demand.

- Regulatory Developments: Government regulations can either boost or hinder Bitcoin’s adoption, impacting prices.

These factors have shaped Bitcoin’s past performance and are expected to continue affecting its value as we approach 2025.

2. Expert Insights on Bitcoin Price Prediction 2025

Many industry experts believe that Bitcoin price prediction for 2025 will bring BTC closer to $100,000. Here’s a look at what some of the top analysts and financial institutions anticipate:

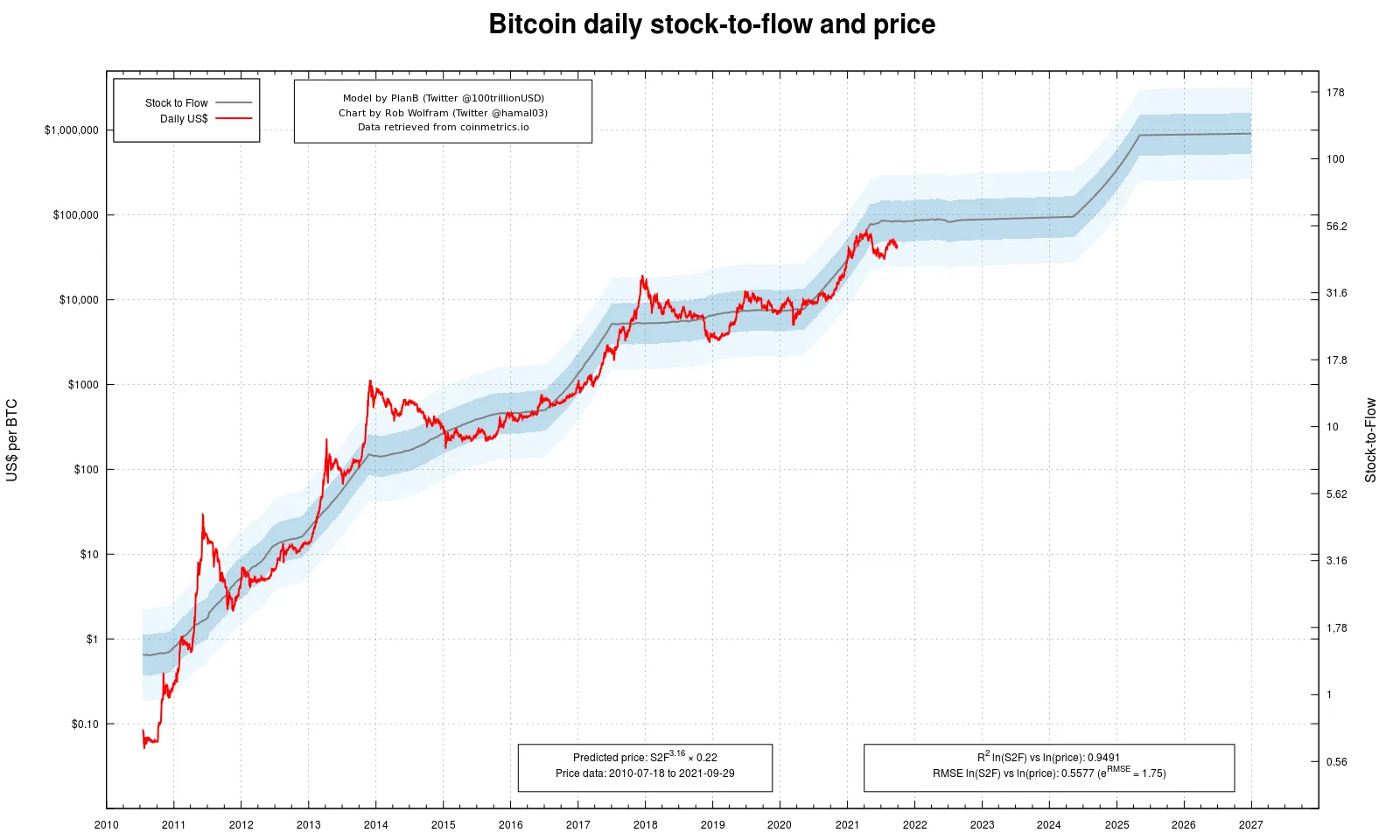

- PlanB’s Stock-to-Flow Model: PlanB, a prominent crypto analyst, has long held that Bitcoin’s stock-to-flow model points to prices surpassing $100,000 in the near future, with 2025 being a pivotal year.

- JPMorgan’s Crypto Forecasts: JPMorgan analysts have projected Bitcoin to reach six-figure territory, particularly if it becomes a reliable store of value comparable to gold.

- Ark Invest’s Bold Prediction: Cathie Wood’s Ark Invest sees Bitcoin potentially reaching $500,000 by the end of the decade, with a significant portion of this growth expected by 2025.

These experts highlight the potential for Bitcoin price prediction 2025 to reach and even exceed the $100,000 mark, contingent on factors like adoption rates, economic conditions, and regulatory clarity.

3. Factors That Could Push Bitcoin to $100,000

Achieving the Bitcoin price prediction 2025 of $100,000 will require specific conditions, including:

a) Increased Institutional Adoption

In recent years, we’ve seen significant institutional investment in Bitcoin, from companies like Tesla to asset managers like Fidelity. If this trend continues, the increased demand could push prices upward, helping Bitcoin achieve that six-figure mark.

b) Bitcoin’s Role as a Hedge Against Inflation

As inflation becomes a concern in global economies, Bitcoin’s appeal as “digital gold” strengthens. This shift in perception could play a critical role in Bitcoin price prediction 2025, with more investors viewing Bitcoin as a hedge against inflation.

c) Technological Advances and Scalability Solutions

Scaling issues have historically hindered Bitcoin, but advances like the Lightning Network are helping make Bitcoin transactions faster and cheaper. Improvements in scalability can enhance Bitcoin’s usability, attracting more users and potentially driving up prices.

d) Regulatory Developments

While regulations are a double-edged sword, clear and supportive policies could significantly boost Bitcoin’s value. If major economies adopt favorable regulations, Bitcoin price prediction 2025 could very well reach $100,000 or beyond.

4. Risks and Challenges to Bitcoin’s Growth in 2025

Predicting the future of any financial asset is difficult, and Bitcoin price prediction 2025 is no exception. Some challenges Bitcoin might face include:

- Regulatory Crackdowns: Aggressive regulatory stances by major economies could restrict Bitcoin’s adoption.

- Market Volatility: Bitcoin’s notorious volatility may deter some investors, especially institutions looking for stability.

- Technological Risks: Security threats like hacking or potential technological issues could impact Bitcoin’s reputation and adoption.

Despite these challenges, many experts remain optimistic about Bitcoin’s long-term potential.

5. Comparing Bitcoin Price Prediction 2025 to Previous Bull Runs

To understand the trajectory of Bitcoin price prediction 2025, it’s helpful to look at past price patterns and bull runs:

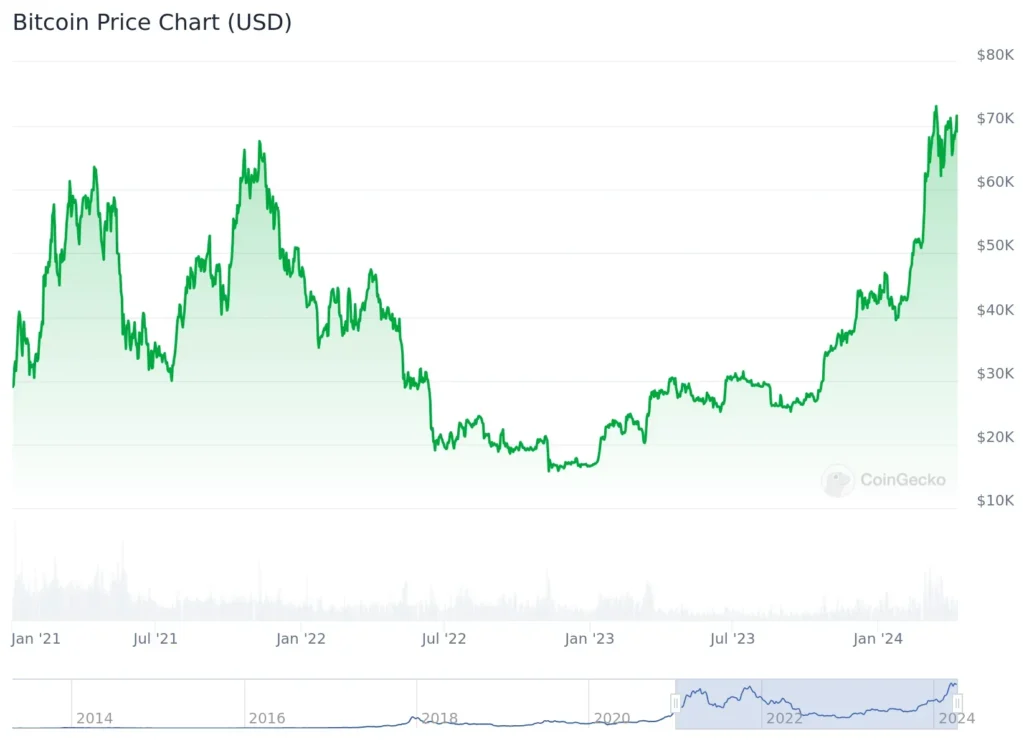

- 2017 Bull Run: Bitcoin surged to nearly $20,000, largely driven by retail interest and early institutional involvement.

- 2021 Bull Run: With increased institutional interest and significant market support, Bitcoin reached an all-time high of around $68,000.

If historical patterns continue, the 2024–2025 period could see another significant rally, potentially pushing Bitcoin toward or even beyond the $100,000 mark.

6. What $100,000 Bitcoin Could Mean for the Crypto Market

A six-figure Bitcoin would have considerable implications for the broader crypto ecosystem, including:

- Increased Adoption of Altcoins: If Bitcoin price prediction 2025 reaches $100,000, it may encourage further investments in alternative cryptocurrencies (altcoins) as investors diversify.

- DeFi and NFT Markets Expansion: With Bitcoin’s success, decentralized finance (DeFi) and non-fungible token (NFT) markets could see renewed interest, drawing in more capital and innovation.

- Institutional Investment Surge: A $100,000 Bitcoin would further validate cryptocurrency as an asset class, potentially leading to a surge in institutional interest across all cryptocurrencies.

Bitcoin reaching $100,000 would likely serve as a catalyst, driving growth and innovation throughout the entire cryptocurrency market.

7. Alternative Bitcoin Price Predictions for 2025

Not all predictions see Bitcoin reaching $100,000 by 2025. Some analysts believe BTC may face resistance due to economic factors, regulatory challenges, or market saturation. For instance:

- Conservative Predictions: Some analysts believe that Bitcoin may remain between $50,000 and $80,000, especially if the market consolidates.

- Extreme Bull Cases: On the other hand, more optimistic forecasters argue that Bitcoin could far surpass $100,000, even reaching $200,000, if it becomes a mainstream asset class.

These alternative views add depth to Bitcoin price prediction 2025 discussions, showing a range of possibilities based on differing assumptions.

8. How to Invest in Bitcoin with a 2025 Outlook

For those aiming to benefit from Bitcoin price prediction 2025, strategic investment approaches include:

- Long-Term Holding (HODLing): Many investors choose to buy and hold Bitcoin for the long term, believing in its potential to reach new heights.

- Dollar-Cost Averaging (DCA): By investing a set amount regularly, investors can mitigate the impact of volatility and potentially benefit from long-term growth.

- Diversifying with Altcoins: Adding other promising cryptocurrencies to a portfolio can balance risk and provide exposure to the broader market.

These investment strategies can help you position yourself well for potential gains in line with Bitcoin price prediction 2025.

Conclusion

The question of Bitcoin price prediction 2025 is complex and involves numerous variables. While reaching $100,000 is an ambitious goal, many factors suggest that it’s achievable, given the growing interest from institutional investors, Bitcoin’s role as an inflation hedge, and advancements in technology. As always, any prediction remains speculative, and potential investors should approach it with caution.

Whether Bitcoin hits $100,000 or not, one thing is clear: Bitcoin continues to be a transformative force in the financial world. Keeping an eye on these trends and predictions will be essential for anyone interested in the future of cryptocurrency.